XRP price outlook: $8 bull case vs tempered baselines The XRP price narrative has heated up again, with a vocal bull camp pointing to an $8 target by 2025. A recent roundup by Mitrade notes that while enthusiastic projections exist, many mainstream models cluster lower in the $3–$5 zone unless catalysts stack (regulatory clarity, payments traction and broad risk-on conditions). Even so, sentiment remains constructive: coverage highlights improving momentum and a path for higher highs if adoption and macro tailwinds cooperate, though the base case still emphasizes a mid-single-digit roadmap rather than double digits in 2025. Why Remittix keeps stealing the spotlight Against that backdrop, Remittix is drawing outsized attention thanks to 6,600% growth projections circulating in analyst takes and press coverage. These pieces argue RTX’s PayFi model focused on practical, cross-border payments offers a more direct line between network activity and value capture than many general-purpose Layer-1s, which is why some investors view it as the cycle’s high-beta challenger to XRP. Importantly, Remittix’s momentum isn’t just narrative: reporting points to $19.3M+ raised, a pending wallet rollout and real-world payment utility as the pillars under the thesis that RTX could outpace legacy large caps on a percentage basis if execution continues. XRP vs RTX: different engines, different ceilings Coverage frames XRP as the established payments asset with institutional relationships and a maturing ecosystem traits that can compress upside per unit of new adoption. That’s why several summaries lean to $3–$5 as a realistic 2025 range, while acknowledging an $8 stretch if catalysts align. By contrast, RTX is portrayed as earlier-stage and utility-first, with upside tethered to product rollout and user growth. This is where the 6,600% figure appears: it’s a projection contingent on delivery (wallet launch, on-ramps/off-ramps and continued fundraising), not a guarantee yet it explains why attention has tilted toward RTX in recent weeks. Source: Trading View Bottom line If you’re tracking the XRP price, the market’s center of gravity still sits in the mid-single digits for 2025, with $8 a credible but conditional bull case. Meanwhile, Remittix is winning headlines for its 6,600% upside projections and tangible payments focus, buoyed by reports of $19.3M+ in funds raised and an approaching wallet milestone. In short: XRP remains the blue-chip payments play; RTX is the high-octane contender capturing this cycle’s speculative imagination. Discover the future of PayFi with Remittix by checking out their project here: Website: https://remittix.io/ Socials: https://linktr.ee/remittix $250K Giveaway: https://gleam.io/competitions/nz84L-250000-remittix-giveaway The post XRP bulls target $8 by 2025, but RTX already tracking for 6,600% gains in 2025 alone appeared first on Invezz

Crypto ETPs Log Record-Breaking Inflows

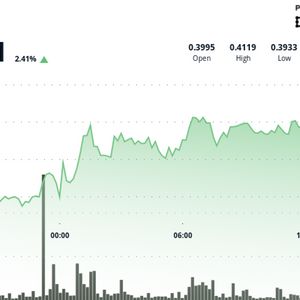

Crypto ETPs Log Record-Breaking Inflows